Getting The Debt Collection Agency To Work

Wiki Article

Rumored Buzz on Personal Debt Collection

Table of Contents5 Simple Techniques For Personal Debt CollectionOur Dental Debt Collection StatementsBusiness Debt Collection for DummiesThe smart Trick of Business Debt Collection That Nobody is Discussing

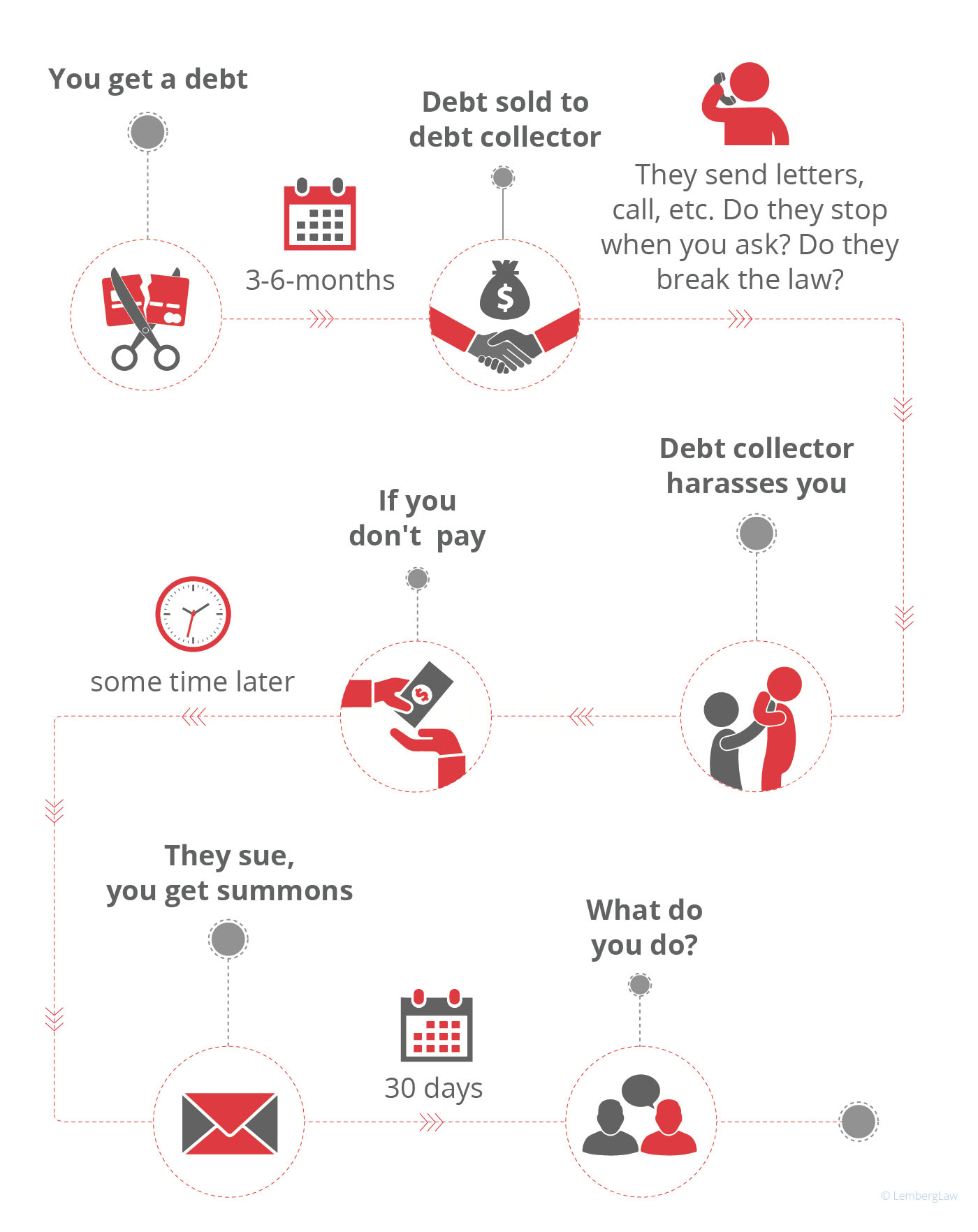

The financial debt customer gets only a digital data of information, often without supporting proof of the financial obligation. The financial obligation is also typically very old financial obligation, occasionally described as "zombie financial debt" because the financial debt purchaser tries to revive a debt that was past the statute of restrictions for collections. Debt collection firms may call you either in writing or by phone.

Not speaking to them will not make the financial debt go away, and also they might simply try alternate methods to contact you, consisting of suing you. When a debt enthusiast calls you, it's important to obtain some first information from them, such as: The debt collector's name, address, as well as phone number. The total amount of the financial debt they claim you owe, consisting of any costs and also passion costs that might have accrued.

Rumored Buzz on Private Schools Debt Collection

The letter needs to mention that it's from a financial debt collector. Call and also attend to of both the financial debt collection agency and the borrower. The lender or creditors to whom the debt is owed. An inventory of the financial obligation, including fees and also passion. They need to likewise inform you of your rights in the debt collection process, as well as exactly how you can contest the debt.If you do contest the financial obligation within thirty days, they have to discontinue collection initiatives up until they give you with proof that the financial debt is yours. They have to offer you with the name and also address of the original financial institution if you request that details within thirty day. The financial obligation validation notification should include a form that can be made use of to call them if you desire to contest the financial obligation.

Some points financial debt enthusiasts can not do are: Make repeated phone calls to a borrower, planning to frustrate the debtor. Usually, unsettled financial obligation is reported to the credit report bureaus when it's 30 days past due.

If your financial debt is moved to a financial debt enthusiast or offered to a financial obligation customer, an entrance will be made on your credit history report. Each time your financial debt is marketed, if it remains to go unsettled, one more access will certainly be contributed to your debt record. Each negative entry on your credit history report can remain there for up to seven years, even after the debt has been paid.

Fascination About Personal Debt Collection

Yet what should you expect from a debt collector and also how does the procedure work? Read on to learn. Once you've decided to hire a debt collection agency, see to it you select the appropriate one. If you comply with the guidance listed below, you can be positive that you have actually worked with a trusted firm that will manage your account with treatment.Some are much better at obtaining outcomes from bigger companies, while others are proficient at accumulating from home-based companies. See to it you're functioning with a company that will actually offer your requirements. This may seem evident, but prior to you work with a debt collection agency, you need to guarantee that they are qualified as well as accredited to function as financial debt collection agencies.

Before you begin your search, comprehend the licensing requirements for debt collector in your state. This way, when you are interviewing agencies, you can talk wisely about your state's requirements. Contact the firms you speak with to ensure they fulfill the licensing demands for your state, particularly if they are located elsewhere.

You should additionally talk to your Bbb my review here and also the Business Debt Collector Association for the names of trusted and also extremely concerned debt collection agencies. While you may be passing along these financial obligations to a collection agency, they are still representing your company. You require to recognize how they will represent you, exactly how they will certainly function with you, as well as what pertinent experience they have.

Dental Debt Collection for Dummies

Simply because a strategy is legal doesn't suggest that it's something you desire your firm name related to. A trustworthy debt collection agency will deal with you to set out a strategy you can cope with, one that treats your former clients the method you would certainly desire to be dealt with as well as still does the job.If that takes place, one method several companies use is skip mapping. You need to additionally dig right into the collector's experience. Relevant experience enhances the possibility that their collection efforts will be successful.

You should have a point of get in touch with that you can interact with as well as obtain updates from. Business Debt Collection. They need to be able to plainly articulate what will certainly be anticipated from you in the process, what info you'll need to give, and also what the cadence click to read more and also sets off for interaction will be. Your chosen company ought to have the ability to fit your chosen interaction demands, not require you to accept their own

No matter whether you win such a case or not, you wish to be certain that your company is not the one on the hook. Request for proof of insurance from any kind click for info of debt collection agency to secure yourself. This is most typically called a mistakes and noninclusions insurance plan. Financial debt collection is a service, as well as it's not an inexpensive one.

Report this wiki page